Banking Digitalization

Citizen Migration to Digital Banking

Overview

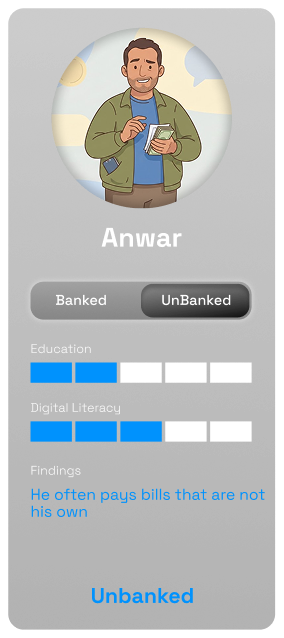

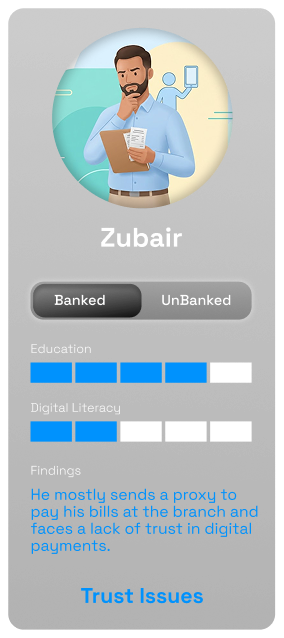

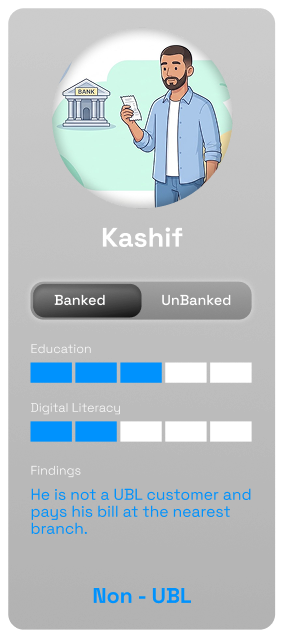

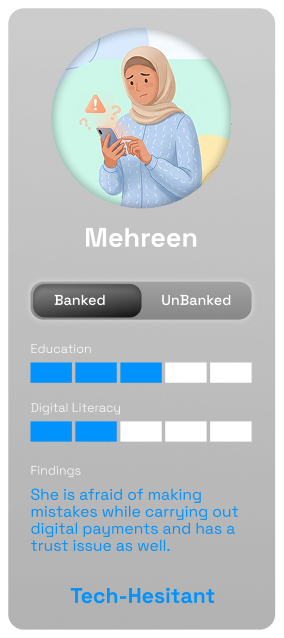

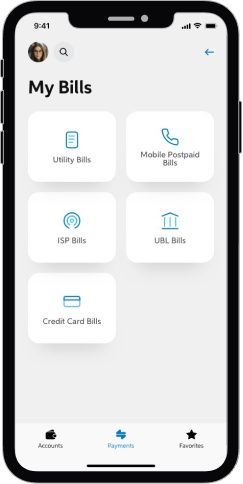

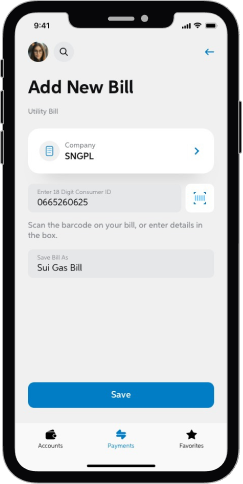

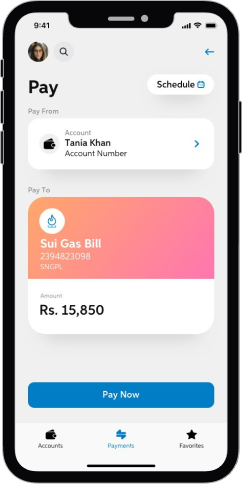

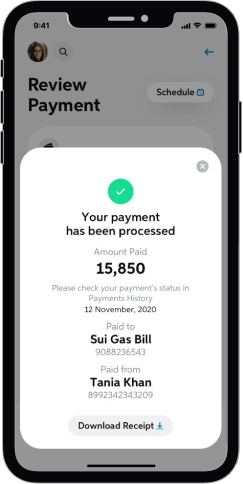

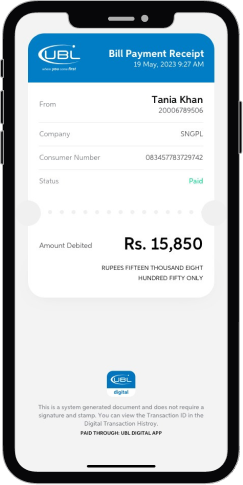

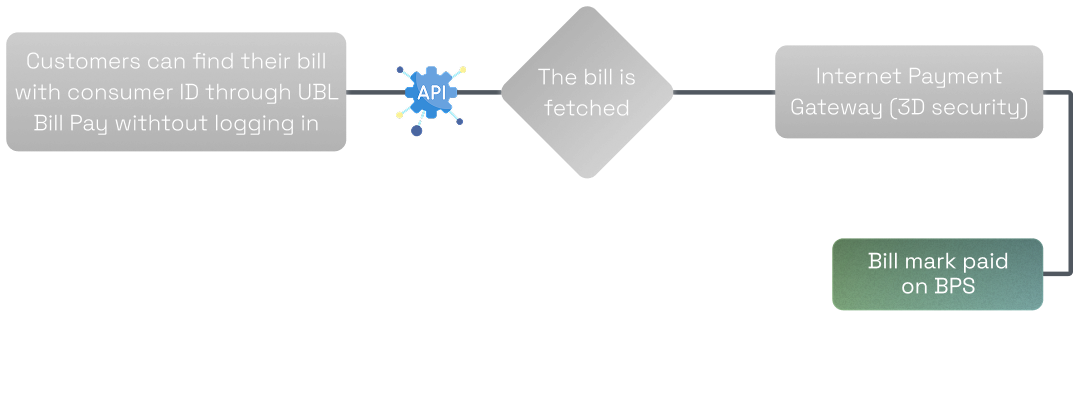

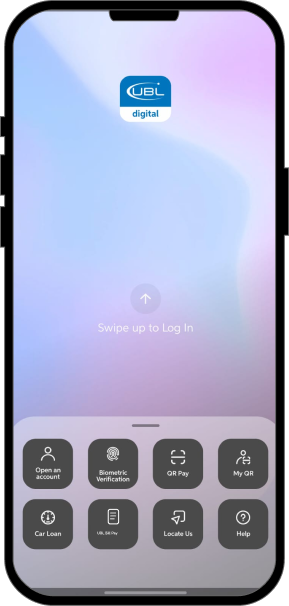

A nationwide innovation and digital transformation initiative for United Bank Limited (UBL) and State Bank of Pakistan. The goal was to migrate citizens from conventional bill payment to digital and introducing RAAST payment to do digital inclusion.

The Challenge

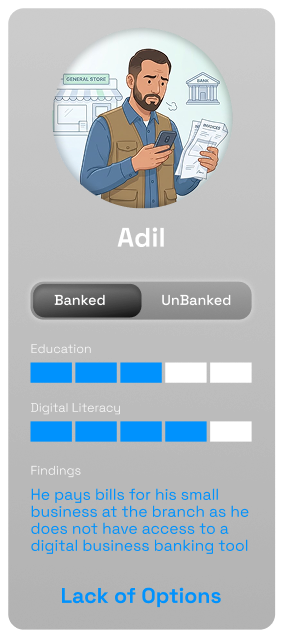

Despite growing digital adoption in the region, most transactions still happen inside branches, and it increases the cost for the bank.

Defining the Problem

UBL handles a substantial share of Pakistan’s PKR 3.5 trillion bill payment market. Despite this:

- Less than 10% of payments are digital

- The rest are made through branches, costing millions every year