Housing Program Transformation

Designing Saudi Arabia’s First Rental Support Insurance Model

Overview

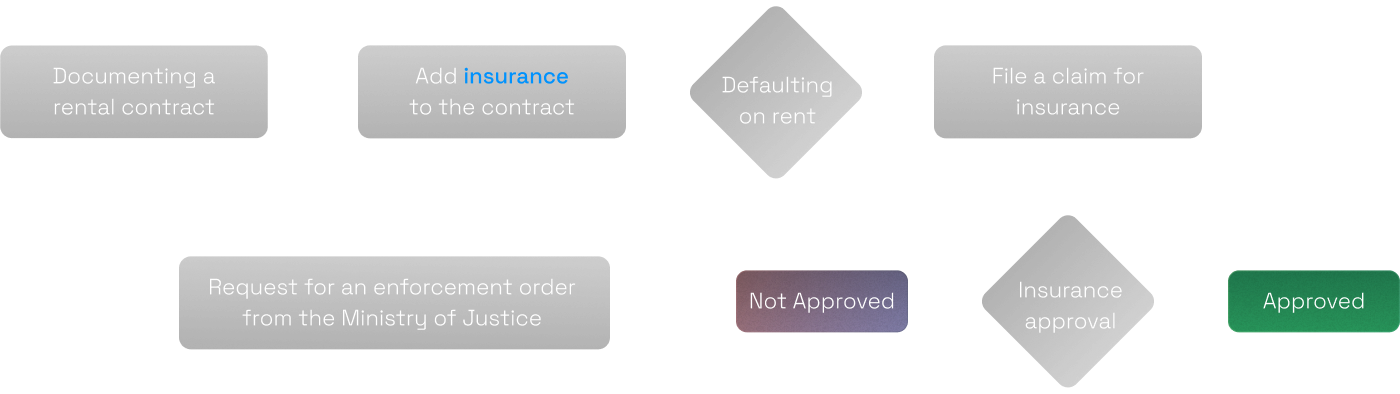

A national initiative to redesign how rental defaults are managed across the Kingdom — shifting from government-funded support toward a sustainable, insurance-backed model. Protecting 140,000+ renters through a data-driven safety net.

The Challenge

Saudi Arabia’s rental market relied heavily on profits from the EJAR platform to cover tenant defaults. The Royal Court mandated a transition toward a more resilient, market-driven financial mechanism ensuring long-term sustainability and reduced government expenditure.

Methodology